One of the founders of Ethereum recently recognized, “it is rare for the interests of idealism and pragmatism to overlap” but in the case of decentralization it “is not just something we should work towards, but something we truly must deliver on.” This fixation on “decentralization” took on new life after blockchain hit the popular press.

Despite BTC reaching 21 month highs, true decentralization of financial systems based on crypto usage will lack mass adoption until there is sufficient trust to render Bitcoin or any other crypto “currency” a real currency. More than likely, this lack of trust is what is stopping the acceptance of crypto for widespread purchases – an essential precursor for any currency status. This failing is likely why the IRS from the very beginning relegated decentralized finance products and crypto’s to the status of taxable financial assets.

To that point, on December 28, 2023, Barrons recognized, “crypto has a long path to relevancy beyond trading. Despite years of development, blockchain networks remain on the outskirts of mainstream finance, while hacks, theft, and money laundering continue to be among the main uses. Crypto is still gambling on an unproven technology.”

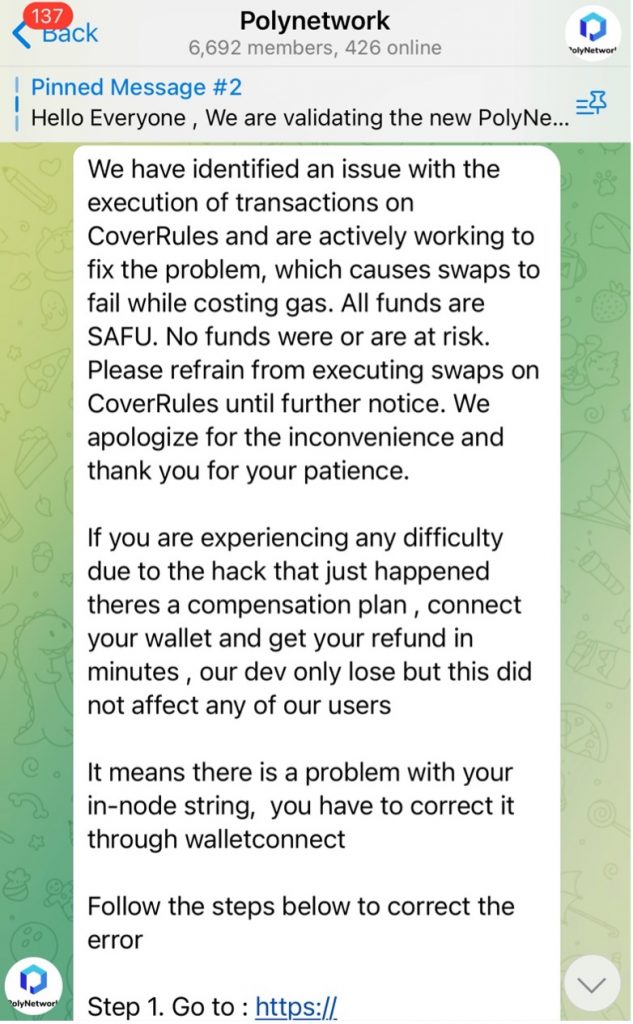

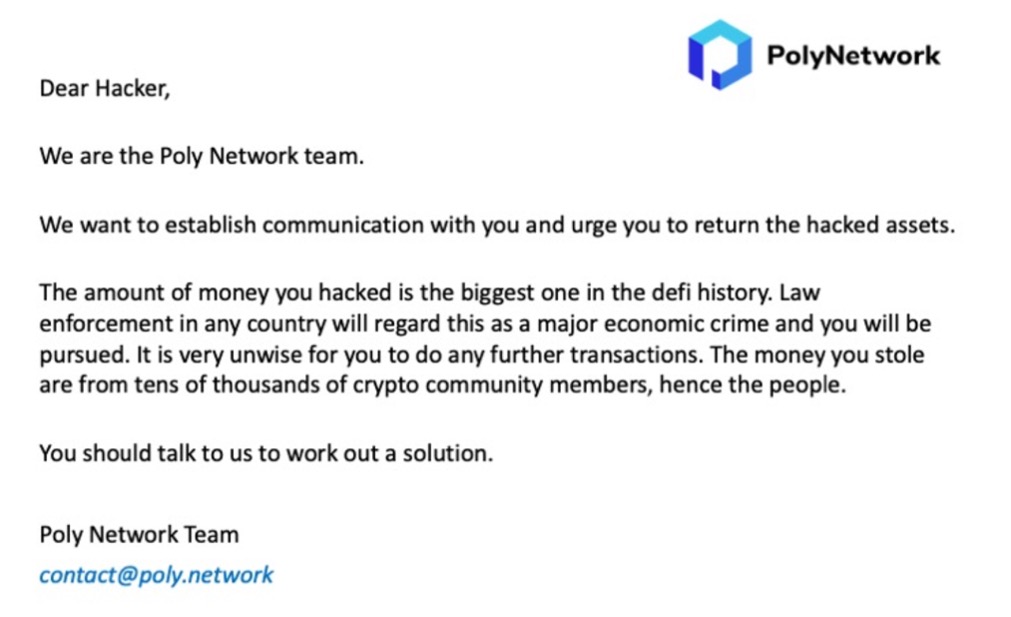

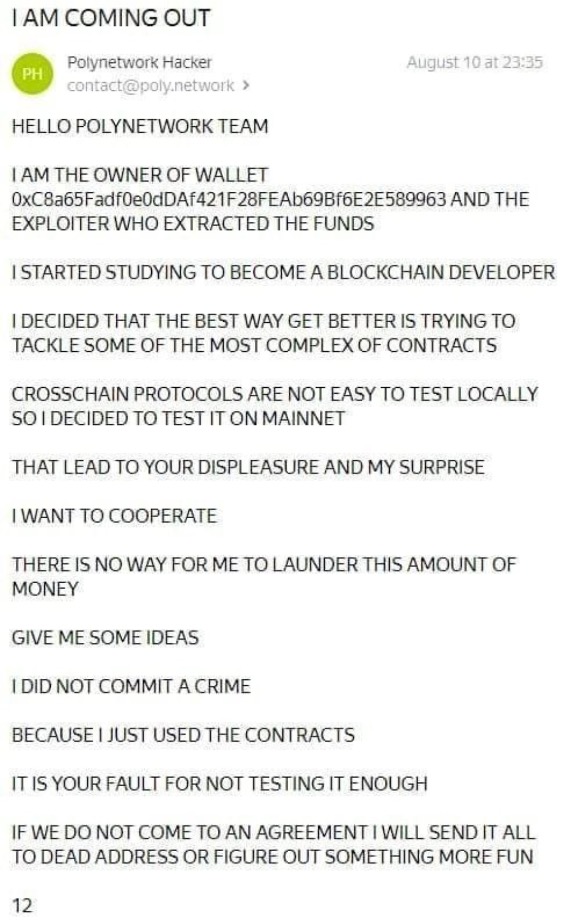

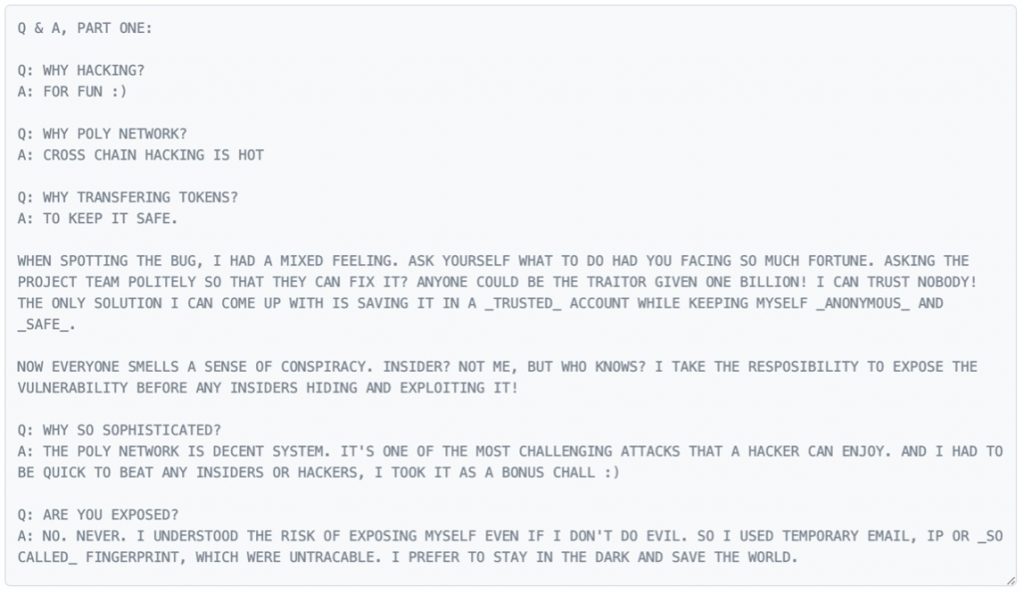

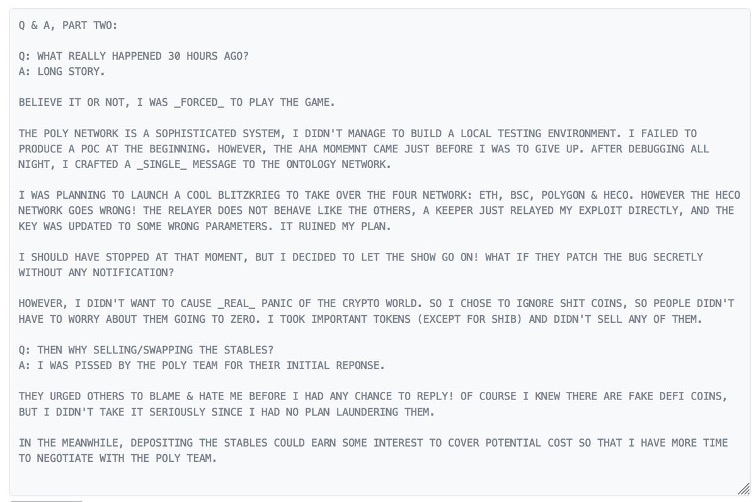

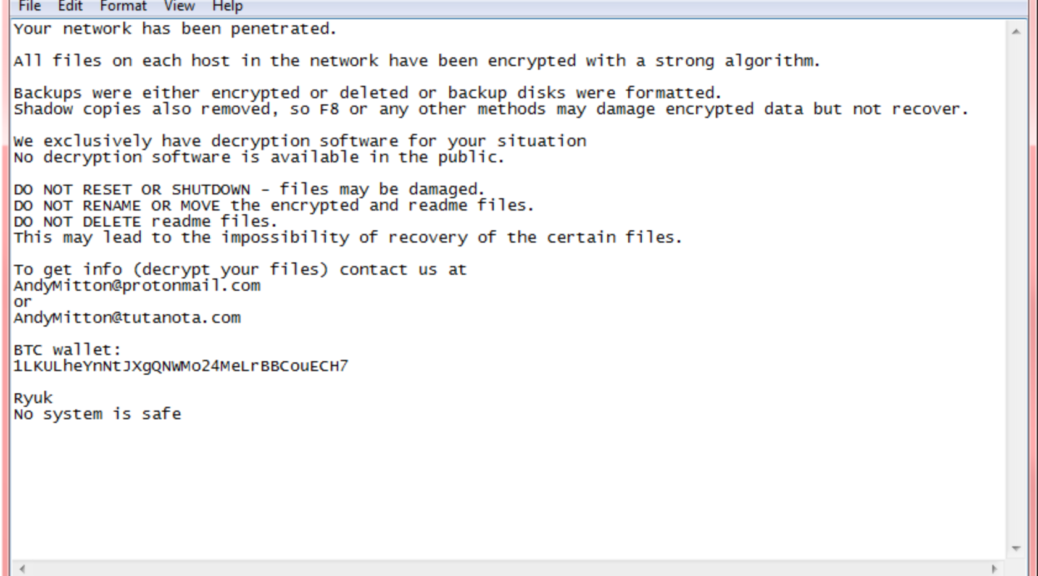

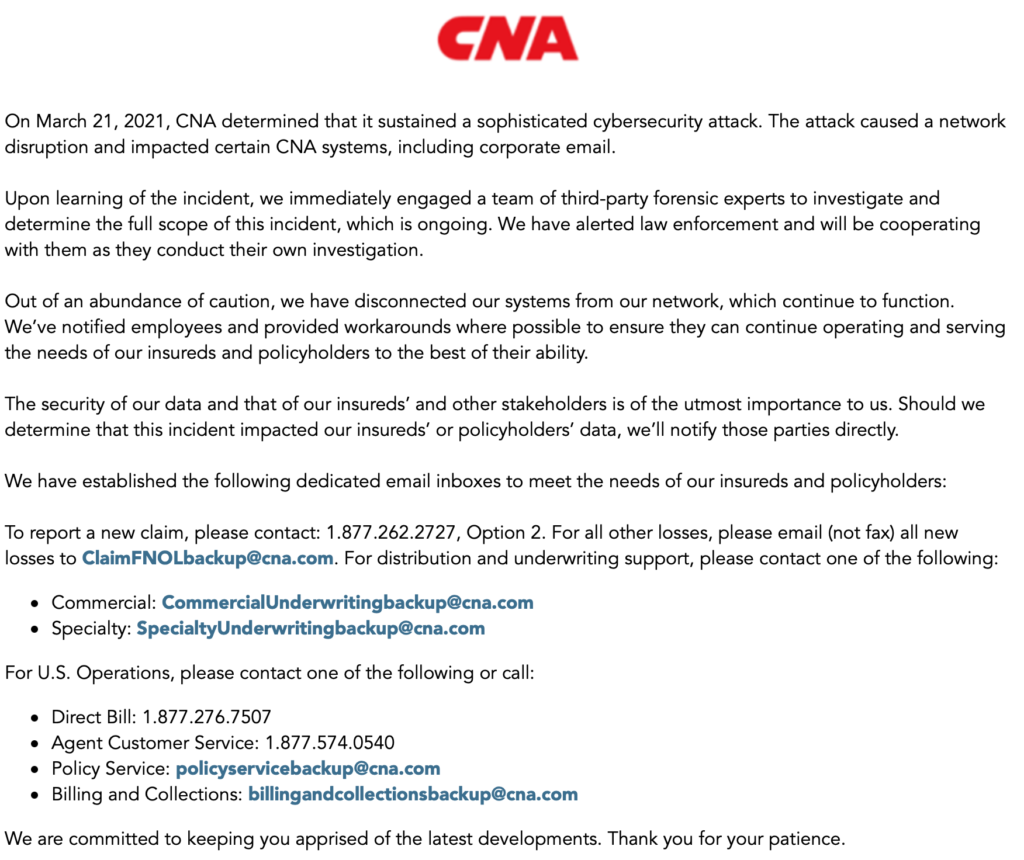

Indeed, decentralized finance (DeFi) opportunities have also been around for nearly a decade with little widespread market penetration. With DeFi platforms, existing growing pains stem from a lack of proper security hygiene sufficient to generate trust and “only with trust will this community ever grow beyond its current early adopters.” Moreover, DeFi platforms and their users face a full frontal attack by centralized banking authorities seeking the sort of financial disclosures currently only found with cash transactions. DeFi will never touch the “PayPalJPMVisa” mountain peak “until at least one DeFi application checks all the relevant boxes for a sizable enough market. It may be a decade before a DeFi project reaches that vantage point – with the classic Amazon vs. Sears endgame likely being studied along the way.”

Decentralization can also take on several non-crypto flavors. For example, the decentralization of governance places local governmental structures above large centralized authorities. The World Bank considers governmental decentralization in the context of community-driven development as a driver of “economic efficiency, public accountability, and empowerment” by providing “greater voice and choice to citizens to influence decisions that affect their lives” and “allowing local governments to respond dynamically to communities”, and resulting in “allocative efficiency by matching of local needs and preferences with patterns of local public expenditure (assumes substantial fiscal autonomy).” In the same breath, the World Bank, suggests that potential dangers and challenges brought on by such decentralization include: “Elite capture, Corruption, Patronage politics, Local civil servants feeling compromised, Incomplete information, Constituents not able to hold representatives accountable, and Opaque decision-making affecting accountability upwards and downwards.”

None of these “potential dangers”, however, are really any less of a risk in centralized governmental structures. Indeed, “elite capture, corruption, and opaque decision-making” can be more efficiently perpetrated within centralized structures. Corporate decentralization in the form of DAOs (decentralized autonomous organizations) have some life given the birthplace of limited liability companies – Wyoming, recognizes such a corporate structure and is typically decades ahead of the pack having been the first to recognize LLCs in 1977. Unlike a standard LLC , “a DAO can be managed by a combination of human members/managers and algorithmically.” Nevertheless, this decentralized business entity even in Wyoming remains an LLC hybrid and can be viewed as an unincorporated association able to be sued. DAOs still remain a decentralized movement to track in 2024 and beyond.

Persistent trust issues and effective governmental interventions may curtail widespread crypto adoption and increasing decentralized governance is a non-starter for most countries, but a third major area of decentralization remains a major threat to existing centralized structures – whether such structures derive from authoritative governments – which describes most existing governmental structures, or derive from financial institutions controlling major financial levers, or even are from the tech companies currently controlling most aspects of online and offline public discourse.

Simply put, the decentralization of one’s identity and personal data using self-sovereign identity (SSI) systems represents the greatest current threat to centralized power structures. Unfortunately, this is not an easy sell or a threat that will manifest anytime soon because, for example, decentralization of one’s digital identity entails asking people to denounce their current online identity built over many years of experience in favor of a clunky and confusing decentralized online persona.

SSI specifications such as W3C VC, OpenID for Verifiable Credentials, SD-JWT – are all directly or indirectly spearheaded by large tech companies and are gaining attention due to potential adoption with European Digital Identity Architecture and Reference Framework, NIST, DHS, etc. It is not difficult to see why these centralized structures are pushing for mostly federated SSI solutions – the EU Parliament sees SSI as a means of enforcing its privacy regime while NIST sees SSI as a means of strengthening cybersecurity and the DHS wants to deploy it as a means of improving physical security.

More to the point, after centralized authorities implement their own SSI solutions their chosen centralized solutions will never really be self-sovereign given centralized access to personal data – especially personal health information, will never be willingly given up by a centralized authority. Even the much-ballyhooed HIPAA turns it back to “de-identified” data sales for “medical research”. Until March 2023, the NIH and other federal agencies previously shared COVID-19 patient health data through several Open-Access Data and Computational Resources. Indeed, there is a reason HIPAA has long had numerous disclosure exemptions that largely swallowed the law’s protective measures.

As it stands, healthcare providers sell patient data for billions of dollars without ever violating a single word of either the HIPAA Privacy Rule or HIPAA Security Rule. Not surprisingly, a 2021 proposed New York Privacy Law was killed in Committee not because of BigTech lobbying – it was shot behind the barn by large hospital lobbyists not keen on having their cash cows disrupted by NYS residents obtaining rights HIPAA does not currently provide. All the while, since 2018 researchers could “accurately match 95% of adults to their data in a deidentified user dataset”.

The roughly 3 billion DNA base pairs found in human DNA can provide a hard-coded template that cannot be currently mimicked . In other words, the future world of rapid-fire DNA ID testing envisioned by Gattaca may eventually be the primary means of distinguishing between individuals.

DNA harvesting for research purposes became mainstream during COVID-19 testing – which is why French President Macron refused Putin’s offer of a PCR test in 2022. The National Human Genome Research Institute describes COVID-19 PCR “amplification” tests as follows: “Polymerase chain reaction (PCR) is a common laboratory technique used in research and clinical practices to amplify, or copy, small segments of genetic material. PCR is sometimes called “molecular photocopying,” and it is incredibly accurate and sensitive. Short sequences called primers are used to selectively amplify a specific DNA sequence. PCR was invented in the 1980s and is now used in a variety of ways, including DNA fingerprinting, diagnosing genetic disorders and detecting bacteria or viruses. Because molecular and genetic analyses require significant amounts of a DNA sample, it is nearly impossible for researchers to study isolated pieces of genetic material without PCR amplification.” It should be no surprise that DNA analytics firms such as 23andMe are targeted by hackers eager to possess the ultimate insight for identity verification and the NIH deployed a wide-ranging voluntary DNA research program on the heels of the eMERGE Network.

Personal identification using DNA fingerprints will become more and more attractive as realistic simulations of human voice, gaits, and images/videos, etc. using generative AI increases the risk biometric identity systems will fail to distinguish real measures from fake ones. Indeed, some vendors now focus heavily on “liveness detection” that recognizes physiological information as signs of life as an adjunct to the associated biometric data. FaceTec is a leader in this space and even hosts its own educational site on the importance of liveness detection. Nevertheless, even these companies will eventually reach a wall in the form of quantum AI capabilities – which points to live rapid-fire DNA testing as the key identity verification tool for future robust SSI implementations.

Where does this leave decentralization in 2024? While SSI, DeFi and governmental decentralization efforts today may self-correct in the future towards true decentralization left apart from centralized authority, there are projects in play right now that might more easily mature in 2024 to further data decentralization. For example, there are efforts taking the form of improved fund distribution – one using a platform created for UNICEF by Nepal-developer, Rumsan, and one called Disburse by Scifn, offering a one-to-many approach. These and other fund distribution platforms can eventually be removed from centralized funding sources.

In addition to Polkadot, peer-to-peer communication platforms such as Veilid allow users to build their own private distributed apps – which creates peer-to-peer communications with no resulting centralized data storage. Believing that centralized social media is “harmful to society”, Spritely Institute replaces the current client-server architecture currently under-girding all existing social medium platforms with a “participatory peer-centric model” that places “people in control of their own identity and build the technology that would enable a shift to collaborative and intentional security models prioritizing active consent.” These approaches still have many mass adoption barriers – the least of which is the competitive market barriers established long ago by current data oligarchs.

SSI left only in the hands of centralized authorities will eventually lead to increased hacking and continued misuse of personal data. Until new statutory requirements bring true portability of personal data – even platform-generated data that is derivative; coupled with meaningful consent rights for existing data usage – rights that limit centralized control when off-boarding to a peer-to-peer platform; individuals will never truly “own” or have control over their personal data. In other words, decentralization of existing data silos cannot become viable until there is a complete reset of existing norms of data stewardship and lobbyists take a backseat to the preeminence of consumer rights. If 2024 brings us even a few inches closer to that reality, it will be a good year for decentralization.