On September 28, 2022, Bloomberg – in pure clickbait fashion, published a blurb article using data from three-year old Unicorn, Dune Analytics, that claims the collectible and digital art market went from a high of $17 billion at the start of the year to $466 million this month. The author ties this downswing to the “$2 trillion wipeout in the crypto sector as rapidly tightening monetary policy starves speculative assets of investment flows.” Whether or not Dune’s data is on the money is almost beside the point.

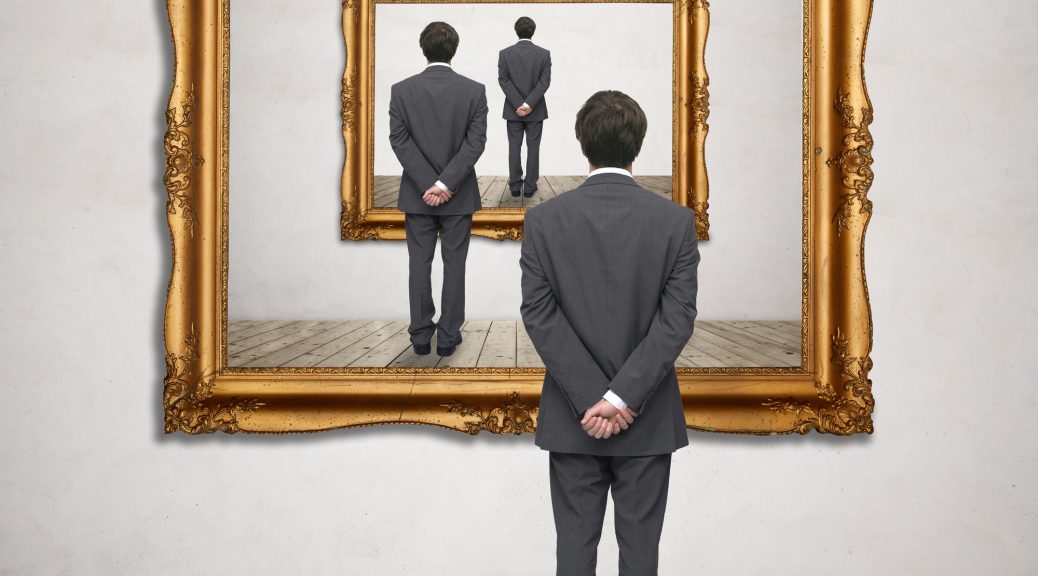

If investors are buying NFTs solely as an investment vehicle, they are not truly art collectors. It’s that simple. No collector buys art purely for speculation – unless you manage a fund tasked with doing exactly that. On the other hand, those who purchase collectible NFTs almost always buy for speculative reasons.

When it comes to deciding what to do during this significant downswing – if it indeed exists, there is not much thinking that needs to be done. If you enjoy the digital art you purchased, this blip does not matter because it was never solely about making a profit. Over time, art has been the most favored non-correlated financial asset for the affluent but it was also always more than just a financial vehicle. That will not likely change in the future. In other words, if you don’t want to see it hanging in your home, it probably should not be in your financial portfolio anyway.