Fine art NFTs slowly but surely prop up blockchain technology while also moving the nascent Digital Fine Art movement – like popcorn placed in a Raytheon microwave oven but in a less pedantic manner. On November 16, 2022, a burning question for NFTs is whether the unfolding FTX disaster advances or hinders their cause.

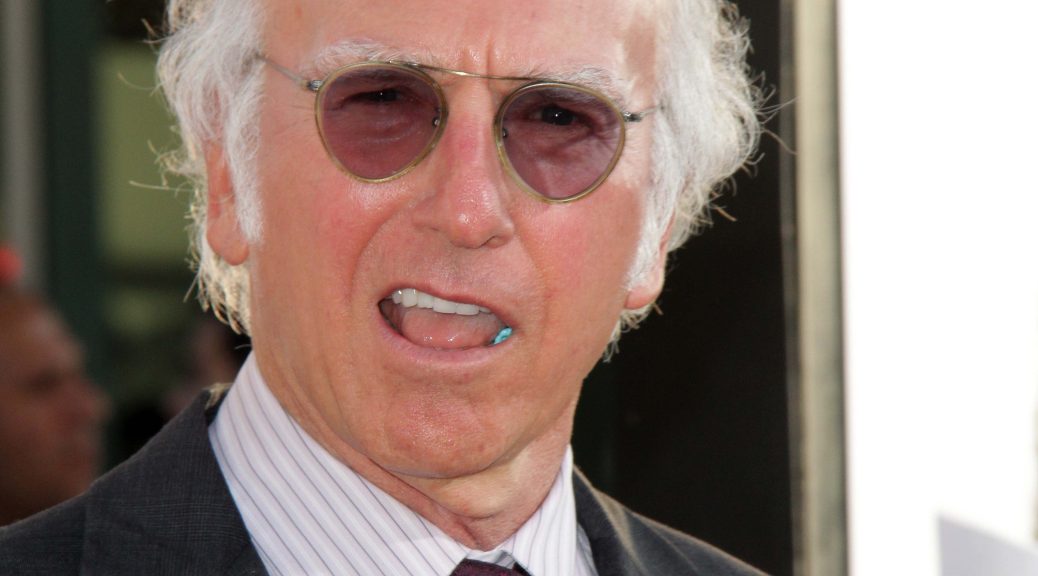

Over 230 years ago, Courts recognized that fraud taints everything it touches. Snyder v. Findlay, 1 N. J. Law (Coxe) 48, 51 (1791). Notwithstanding the good intentions of respected celebrity endorsers Larry David, Tom Brady and Stephen Curry, the fraudster Sam Bankman-Fried – now derided as “Sam Bankrun-Fraud”, incredibly avoided internal detection by stealing and hiding funds using his own personal backdoor software tool. By trading client assets, his massive fraud did the exact opposite of what his firm contractually promised clients as a condition of FTX’s custody.

Fried’s fraud has become a major contagion in the crypto world – some are even posturing FTX as Exhibit “A” in their case against crypto adoption. Despite the pernicious nature of Fried’s massive fraud, there remains underlying positive news given FTX’s failures shine a light on why NFTs will continue having a long and impactive run and why their decentralized nature will eventually become baked into most financial assets. Indeed, the term “NFT” will hopefully disappear from our vernacular given the underlying technology’s future ubiquity. Literally no one cares how “Hypertext Transfer Protocol Secure” works so long as the “https” before a website address gets the job done. Similarly, few really care about the technology behind a “non-fungible token”. Owners only care about having transferable digital property self-containing proof of ownership, verifiable uniqueness and programmable contract attributes.

The FTX debacle immediately adversely impacted NFT markets because NFTs are purchased and sold using cryptocurrencies – most of which took a major hit beginning on November 2, 2022, the publication date of Coindesk’s expose on FTX. And, with Solana’s SOL emerging as this worst-performing crypto asset – losing over 41% in value given FTX was an important backer of the network, several Solana NFT marketplaces, namely Magic Eden and Solanart, felt an even greater FTX sting than other NFT marketplaces.

Despite the fact NFT sales remain on a slow mass adoption cycle, as of November 16, 2022 OpenSea alone still had nearly $33 billion in total NFT trades. NFTs are well beyond the proof-of-concept stage but mass adoption will continue a slow journey given the constant press assaults. For example, in a May 3, 2022 Wall Street Journal hit piece suggesting that it may be “the beginning of the end” for NFTs, Zach Friedman, co-founder and chief operating officer of crypto brokerage Secure Digital Markets, is quoted as saying: “The ones that continue will be utility-focused for sure.”

That perspective is both correct – utility is an intrinsic feature of all NFTs, and wrong given it begs the question: Since when does fine art ever need additional utility for it to gain status as “fine art”? Utility is always found in great art simply by way of the esthetic utility derived. As of the same month as the WSJ article – May 2022, collectors sent over $37 billion to NFT marketplaces, putting them on pace to beat the total of $40 billion sent in 2021. Even though the vast majority of these transactions are not for fine art NFTs, the disrespect shown today for Digital Fine Art remains no different than cubist art in 1910.

At the 1913 Armory Show in New York City, the most famous collectors of modern art originally shunned what they saw. Indeed, after the show travelled to Chicago, members of the Art Institute of Chicago – the first museum brave enough to display these works, burned mock-Matisse and Picasso effigies on the museum’s steps. Today, the Art Institute of Chicago proudly hangs over five hundred important works created by Matisse and Picasso. History will always have an uncanny way of repeating itself.

At an Art Basel panel discussion, Esther Kim Varet, owner of the L.A. and Seoul gallery Various Small Fires, reportedly let the cat out of the bag as to why Digital Fine Art runs against the grain of the fine art world: “There are a lot of barriers and it feels exclusive once you get in. And I fear that the more pricing transparency there is … we’re going to have to invent new ways to create this aura of exclusivity or privilege. Not that those things are things that we should value but it’s just kind of what the art world is built on.”

In other words, pricing opaqueness is positioned as a virtue of the art world community. Not surprisingly, the pricing transparency and documented provenance inherent in Digital Fine Art in the form of NFTs in some ways runs counter to this view of the art world. While the actual art in Digital Fine Art provides utility plain and simple, the programmable nature of the smart contracts used in NFTs provides a world of opportunity for collectors and artists. Such underlying contractual rights can create a lifetime relationship between collector and artist – one with ties to direct interactions removed from any centralized control. More to the point, fine art galleries and dealers can readily join in this new form of relationship. Ultimately, the only barriers to the heights Digital Fine Art can achieve is driven by a lack of imagination and a fear of the unknown.

UPDATE: December 13, 2022

On December 13, 2022, the SEC filed criminal charges against Bankman-Fried. The complaint alleges he “orchestrated a years-long fraud to conceal from FTX’s investors (1) the undisclosed diversion of FTX customers’ funds to Alameda Research LLC, his privately-held crypto hedge fund; (2) the undisclosed special treatment afforded to Alameda on the FTX platform, including providing Alameda with a virtually unlimited “line of credit” funded by the platform’s customers and exempting Alameda from certain key FTX risk mitigation measures; and (3) undisclosed risk stemming from FTX’s exposure to Alameda’s significant holdings of overvalued, illiquid assets such as FTX-affiliated tokens.”

In parallel actions, the U.S. Attorney’s Office for the Southern District of New York and the Commodity Futures Trading Commission also announced their own charges against Bankman-Fried.

Given that he was about to testify before Congress, the timing of the SEC and CFTC actions are not nearly as important as that of the criminal indictment. In effect, the DOJ has prevented a potential treasure trove of wholly admissible statements from being elicited. Now that he has been indicted and arrested in the Bahamas, lawyers will be the only ones talking for money-runner SBF. That’s too bad.